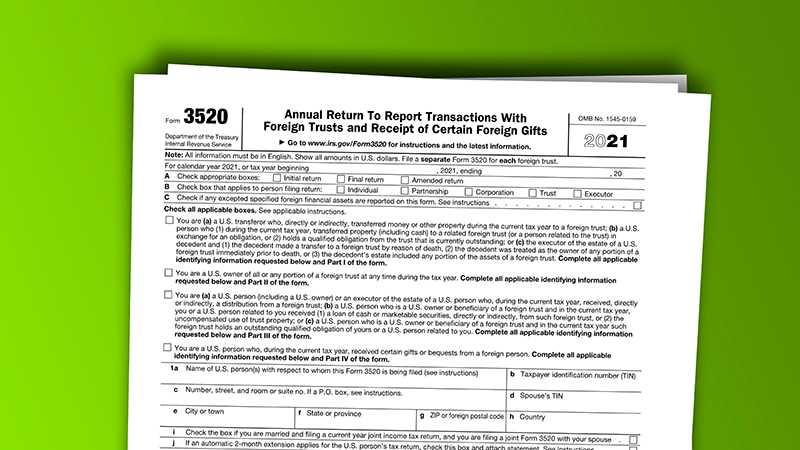

IRS Form 3520 inheritance: FAQs answered

Wiki Article

The Advantages of Timely Coverage Foreign Inheritance to IRS and Its Effect on Your Funds

Timely reporting of international inheritance to the IRS can greatly influence an individual's economic landscape. By comprehending the reporting requirements, one can avoid lawful issues and potential penalties - foreign gift tax reporting requirements. Additionally, there are tax benefits associated with prompt declaring that might improve total monetary planning. The implications of these actions can be far-reaching, impacting investment possibilities and possession administration strategies. What continues to be to be discovered are the ins and outs of international inheritance legislations and their consequencesComprehending IRS Reporting Demands for Foreign Inheritance

They have to browse certain IRS coverage needs to guarantee compliance when individuals get an inheritance from abroad. The IRS mandates that U.S. residents and homeowners report international inheritances surpassing $100,000 on Form 3520, which schedules on the very same day as their tax return. This form captures essential details regarding the inheritance, including the quantity got and the connection to the decedent. Furthermore, any kind of international checking account related to the inheritance may call for reporting under the Foreign Financial Institution and Financial Accounts (FBAR) laws if the accumulated value goes beyond $10,000. Comprehending these requirements is crucial, as failing to record can cause substantial penalties. Individuals should stay conscious of any kind of relevant estate taxes that may occur from international inheritances, particularly if the estate surpasses particular limits. Correct adherence to these standards assurances that individuals manage their financial responsibilities efficiently and prevent difficulties with the IRS.Preventing Penalties and Legal Issues

Guiding with the complexities of foreign inheritance reporting can be frightening, yet understanding the demands is essential for preventing charges and legal concerns. The IRS enforces strict standards on reporting foreign inheritances, and failing to abide can result in severe effects. Taxpayers need to understand types such as the FinCEN Form 114 and IRS Type 3520, which offer to divulge foreign gifts and inheritances properly.Noncompliance can cause significant fines, and in some instances, criminal costs might be sought. Furthermore, unreported inheritances can complicate estate issues, resulting in further lawful problems. Accurate and prompt coverage not only alleviates these dangers yet additionally fosters openness and trust fund with tax obligation authorities. By focusing on compliance, people can focus on handling their newfound possessions instead of maneuvering possible lawful disputes or fines - reporting foreign inheritance to IRS. Ultimately, recognizing reporting needs is essential for maintaining monetary assurance

Prospective Tax Obligation Benefits of Timely Reporting

The key emphasis of reporting international inheritances typically centers on conformity, timely reporting can additionally expose possible tax benefits. By without delay disclosing international inheritances to the IRS, people may have the ability to capitalize on particular exceptions and reductions that can lower their overall tax obligation obligation. For example, the IRS allows certain international inheritance tax credits that can counter U.S. tax obligations. In addition, timely coverage may promote using the annual gift tax obligation exemption, making it possible for recipients to disperse sections of their inheritance to friend or family without sustaining extra tax obligation liabilities.Moreover, early coverage can offer clarity on how the inheritance suits an individual's overall financial photo, potentially enabling for strategic tax obligation preparation. This proactive technique reduces shocks and helps individuals make educated choices concerning their monetary future. Inevitably, recognizing these prospective tax advantages can significantly boost the financial benefits of acquiring foreign assets.

Enhancing Financial Preparation and Investment Opportunities

Timely reporting of foreign inheritances not only guarantees compliance with IRS laws yet also opens avenues for boosted financial planning and financial investment possibilities. When people disclose their inheritances promptly, they can strategically incorporate these possessions right into their overall monetary profiles. This proactive method enables better evaluation of internet worth and facilitates educated decision-making pertaining to financial investments.

Navigating Intricacies of International Inheritance Regulations

Steering through the complexities of global inheritance regulations can be challenging, as varying lawful frameworks throughout countries commonly result in confusion and difficulties. Each territory may impose one-of-a-kind rules concerning the circulation of possessions, tax commitments, and required paperwork, complicating the procedure for successors. This intricacy is intensified by the capacity for clashing regulations, specifically when the deceased had assets in numerous nations.Frequently Asked Concerns

What Forms Are Required for Reporting Foreign Inheritance to the IRS?

To report international inheritance to the IRS, individuals typically need to file Form 3520, which reports foreign presents and inheritances, and might additionally require Type 8938 if foreign assets surpass particular thresholds.

Exactly How Does Foreign Inheritance Affect My Estate Tax Responsibilities?

Foreign inheritance might increase inheritance tax responsibilities depending on the total worth of the estate and relevant exemptions. Appropriate reporting warranties compliance with IRS regulations, possibly affecting future tax obligation obligations and estate planning approaches.Can I Obtain Foreign Inheritance in Installments?

What Is the Due date for Coverage a Foreign Inheritance?

The target date for reporting an international inheritance to the IRS is commonly April 15 of the following year after getting the inheritance. Expansions may use, yet prompt reporting is important to prevent fines.

Are There Exemptions for Little Foreign Inheritances?

Yes, there are exemptions for little international inheritances. Individuals reporting foreign inheritance to IRS may not need to report inheritances listed below a specific threshold, which varies by jurisdiction. Consulting a tax obligation expert is recommended for details support concerning individual circumstances.

Report this wiki page